Used Tractor and Combine Asking Prices Trend Downward as Interest Rates Remain Steady and Crop Prices Drop

PR Newswire

LINCOLN, Neb., Sept. 5, 2025

LINCOLN, Neb., Sept. 5, 2025 /PRNewswire/ -- According to the newest Sandhills Global market reports, asking prices for used tractors and combine harvesters on TractorHouse.com and other Sandhills platforms are trending down. Both markets posted monthly and year-over-year decreases in August. Market factors influencing this trend include unchanged interest rates and lower crop prices.

Sandhills market reports cover used farm equipment, construction equipment, trucks, and semi-trailers on Sandhills platforms. In the used heavy-duty and medium-duty construction equipment markets, monthly asking and auction values have changed little in recent months, with changes not exceeding 2% in any month since March. In the heavy-duty truck and semi-trailer markets, asking and auction values are mixed.

The key metric in all of Sandhills' market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets and model-year equipment actively in use. EVI spread measures the percentage difference between asking and auction values.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills' used heavy-duty truck, semi-trailer, farm machinery, and construction equipment markets. Key points from the current reports are listed below. Full reports are available upon request.

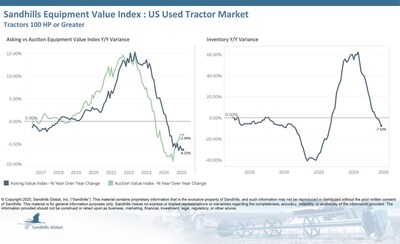

U.S. Used Tractors 100 Horsepower and Greater

- Inventory levels in this market continued their downward trend in August with decreases of 1.85% M/M and 7.52% YOY. The 100- to 174-horsepower tractor category made the biggest impact on inventory in the overall market, with inventory levels dropping 2.87% M/M and 16.55% YOY.

- Asking prices continued dropping as well, posting decreases of 0.11% M/M and 6.22% YOY in July. 300-plus-HP tractors led other categories in asking price changes with decreases of 0.66% M/M and 6.29% YOY.

- Auction values are also trending down. Auction values decreased by 0.47% M/M in August, led by the 300-plus-HP tractor category with a 1.45% M/M decrease. Auction values were down 2.95% YOY, with 175- to 299-HP tractors leading other categories with a 4.19% YOY drop.

- The EVI spread, which measures the percentage difference between asking and auction values, held steady at 39%. This is close to peak values observed in 2015.

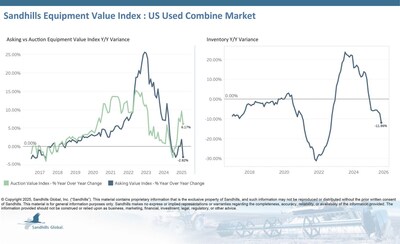

U.S. Used Combines

- Inventory levels of used combine harvesters fell 6.62% M/M and 11.86% YOY in August and are trending down.

- Asking prices are also trending down, posting 5.84% M/M and 2.82% YOY drops in August.

- Auction values fell 5.02% M/M but were up 6.17% YOY and are trending sideways.

- The EVI spread remained at 43%, which is lower than the peak values seen in 2015.

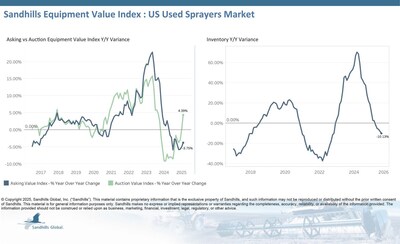

U.S. Used Sprayers

- Inventory levels of used sprayers have been trending downward for six months. In August, inventory levels were up 1.17% M/M but down 10.13% YOY.

- Asking values have been trending down for five months in a row. This trend continued in August with decreases of 0.16% M/M and 3.75% YOY.

- Auction values, on the other hand, are trending sideways, rising 1.29% M/M and 4.39% YOY in August.

- The EVI spread for used sprayers dropped two points to 41%, lower than the 2015 peak values.

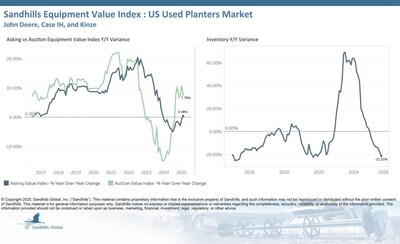

U.S. Used Planters

- Inventory levels in the U.S. used planter market fell 1.04% M/M and 21.22% YOY in August and are trending sideways.

- Asking values are also trending sideways, posting increases of 4.57% M/M and 0.48% YOY in August.

- Auction values were up 3.34% M/M and 7.78% YOY and are trending up.

- The EVI spread in this market increased one point from July to 52%, which is still lower than the peak values observed in 2015.

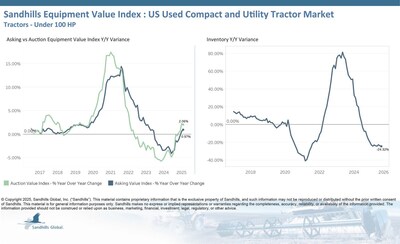

U.S. Used Compact and Utility Tractors

- Inventory levels in this market continued a 10-month-long downward trend in August, with decreases of 2.78% M/M and 24.32% YOY. The less-than-40-HP tractor category posted the largest drops, down 3.73% M/M and 27.68% YOY.

- Asking values are trending up, following increases of 0.65% M/M and 0.97% YOY in August. 40- to 99-HP tractors led other categories in M/M asking value increases with a 1.2% gain, while less-than-40-HP tractors took the lead in YOY decreases with a 1.53% drop.

- Auction values are also trending up. Auction values rose marginally M/M in August, by 0.4%, and by 2.06% YOY. The 40- to 99-HP tractor category showed both the largest M/M auction value increase at 0.94% and the largest YOY increase at 0.24%.

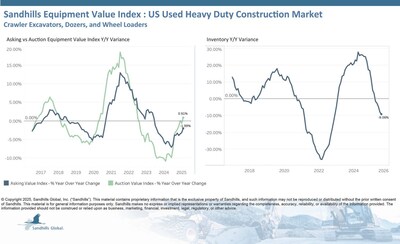

U.S. Used Heavy-Duty Construction Equipment

- Inventory levels of used heavy-duty construction equipment, which includes crawler excavators, dozers, and wheel loaders, were up 0.2% M/M and down 9.06% YOY in August and are trending downward. Used wheel loaders led other categories in M/M inventory level increases, up 0.75%. The used crawler excavator category posted the largest YOY inventory decrease with a 12.42% drop.

- Asking prices in this market were up 0.11% M/M and down 1.99% YOY in August and are trending downward. Used dozers had the largest per-category M/M asking price increase, up 0.57%, while used wheel loaders led other categories in YOY decreases, down 4.1%.

- Auction values continued a 5-month-long sideways trend in August, with increases of 0.16% M/M and 0.91% YOY. Used wheel loaders exhibited the largest M/M auction value increase, up 1.76%. Used crawler excavators showed the largest YOY increase, up 4.25%.

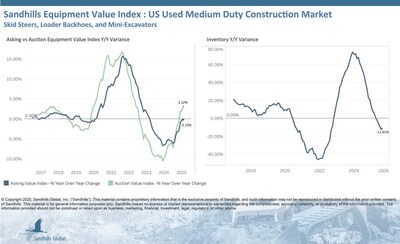

U.S. Used Medium-Duty Construction Equipment

- As in the heavy-duty market, inventory levels of used medium-duty construction equipment are trending downward. This market, which includes used skid steers, loader backhoes, and mini excavators, showed inventory level decreases of 0.24% M/M and 11.61% YOY in August. Used mini excavator inventory levels fell the most, down 1.04% M/M and 21.97% YOY.

- Asking values showed minimal changes in August, down 0.54% M/M and 0.15% YOY, and are trending upward. Sandhills observed the largest category asking price changes in used mini excavators, down 0.97% M/M, and used track skid steers, down 3.4% YOY.

- Auction values rose 0.5% M/M and 3.12% YOY in August and are trending upward. Used loader backhoes led other categories in auction value increases, jumping 3.02% M/M and 5.78% YOY.

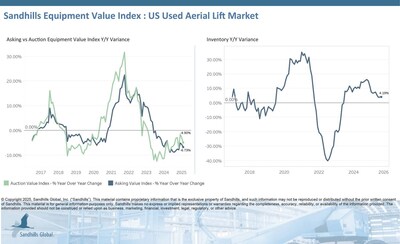

U.S. Aerial Lifts

- Inventory levels of used aerial lifts increased by 1.76% M/M and 4.19% YOY in August and are trending up. Used articulating boom lift inventory levels were up more than other categories M/M, by 4.23%, while used rough terrain scissor lifts led other categories in YOY inventory changes, up 28.38%.

- Asking values were up slightly in August, by 0.26% M/M, but were down 6.73% compared to year-ago values. Asking values have been trending downward for six months. The used rough terrain scissor lift category showed the largest asking price decreases, with drops of 3.63% M/M and 13.98% YOY.

- Auction values increased by 0.58% M/M and decreased by 4.9% YOY in August and are trending sideways. Used slab scissor lifts led other categories in auction value increases with gains of 4.57% M/M and 11.77% YOY.

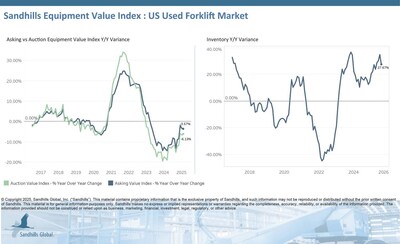

U.S. Forklifts

- Used forklift inventory levels continued a 7-month-long upward trend, posting a 3.18% M/M decrease and a 27.67% YOY increase in August. The used cushion tire forklift category exhibited the largest M/M inventory decrease at 3.64% and the largest YOY increase at 30.85%.

- Asking values in this market have been trending sideways. Asking values decreased by 0.62% M/M and 3.57% YOY in August. The used cushion tire forklift category showed the largest M/M asking value decrease at 1.98%, while the used pneumatic-tire forklift category posted the largest YOY asking value decrease at 5.09%.

- Auction values were down 0.54% M/M and 6.13% YOY in August, continuing a 7-month-long downward trend. Notably, the used cushion tire forklift category showed a 2.88% M/M increase, but the pneumatic-tire forklift category exhibited the largest YOY auction value decrease at 8.45%.

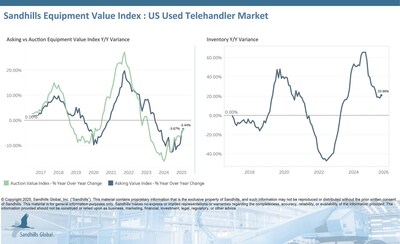

U.S. Telehandlers

- Inventory levels of used telehandlers have been trending upward for 30 months in a row. In August, inventory levels increased by 4.39% M/M and 20.96% YOY.

- Asking values decreased slightly in August, by 0.11% M/M and 3.44% YOY, and are trending sideways.

- Auction values continued their downward trend, inching up by 0.45% M/M but down 3.67% YOY in August.

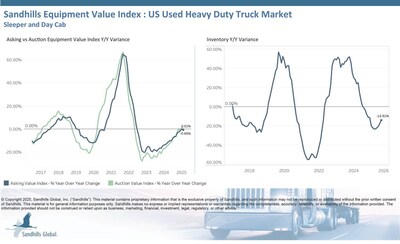

U.S. Heavy-Duty Trucks

- Inventory levels of used day cabs and sleeper trucks have been relatively steady for the past five months. Inventory levels in this market were down 0.16% M/M and 13.91% YOY in August. Used day cabs posted the largest M/M inventory level decrease, down 0.26%, while used sleeper trucks showed the largest YOY decrease, down 20.11%.

- Used heavy-duty truck asking values continued trending up despite slight decreases of 1.45% M/M and 0.65% YOY in August. Used sleeper trucks exhibited the largest M/M asking value decrease at 1.76%, while used day cabs had the largest YOY decrease, down 7.18%.

- Auction values also continued an upward trend, decreasing by 2.13% M/M and remaining almost flat YOY, with a 0.01% increase, in August. Within this market, the greatest auction value changes were observed in used sleeper trucks, down 2.91% M/M, and used day cabs, down 7.51% YOY.

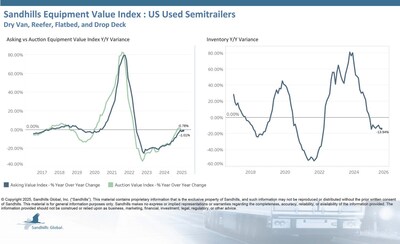

U.S. Used Semi-Trailers

- Continuing a 6-month sideways trend, inventory levels of used semi-trailers were down 0.21% M/M and 13.94% YOY in August. The used reefer trailer category showed the largest M/M inventory increase at 1.76%, while used dry van trailers exhibited the largest YOY inventory decrease at 26.67%.

- Asking values in this market are trending sideways, decreasing by 0.84% M/M and 1.01% YOY in August. Used reefer trailers posted the largest M/M asking value decrease at 2.07%, while used drop deck trailers showed the largest YOY asking value decrease at 3.02%.

- Auction values in this market are trending downward, with August decreases of 0.49% M/M and 0.78% YOY. Used drop deck trailers showed the largest M/M auction value decrease at 3.2%, while used reefer trailers exhibited the largest YOY auction value drop at 3.91%.

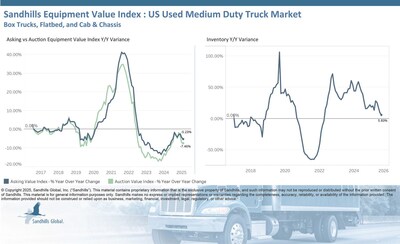

U.S. Used Medium-Duty Trucks

- Inventory levels in this market decreased 8.46% M/M and increased 5.83% YOY in August and are trending sideways.

- Asking values have been trending down for one year. This trend continued in August with decreases of 1.92% M/M and 5.23% YOY.

- Auction Values decreased by 1.05% M/M and 7.46% YOY in August and are trending sideways.

Obtain the Full Reports

For more information or to receive detailed analysis from Sandhills Global, contact us at marketreports@sandhills.com.

About Sandhills Global

Sandhills Global is an information processing company headquartered in Lincoln, Nebraska. Our products and services gather, process, and distribute information through trade publications, websites, and online services that connect buyers and sellers across the construction, agriculture, forestry, oil and gas, heavy equipment, commercial trucking, and aviation industries. Our integrated, industry-specific approach to hosted technologies and services offers solutions that help businesses large and small operate efficiently and grow securely, cost-effectively, and successfully. Sandhills Global—we are the cloud.

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by Value Insight Portal (VIP), Sandhills' proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.

Contact Sandhills

www.sandhills.com/contact-us

402-479-2181

![]() View original content:https://www.prnewswire.com/news-releases/used-tractor-and-combine-asking-prices-trend-downward-as-interest-rates-remain-steady-and-crop-prices-drop-302547947.html

View original content:https://www.prnewswire.com/news-releases/used-tractor-and-combine-asking-prices-trend-downward-as-interest-rates-remain-steady-and-crop-prices-drop-302547947.html

SOURCE Sandhills Global